child tax credit 2021 dates and amounts

Is the Child Tax Credit for 2020 or 2021. You will need to provide the number of children you have in the two age brackets - 5 or younger and 6 to 17 -.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

29 What happens with the child tax credit payments after December.

. Ad Worried about Your Taxes. The Child Tax Credit is a fully refundable tax credit for families with qualifying children. The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families.

3600 for children ages 5 and under at the end of 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Families eligible for the advanced child tax credit payments will receive a letter from the IRS soon the agency said.

This first batch of advance monthly payments worth roughly 15 billion. Learn more about the Advance Child Tax Credit. The advance Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021.

3600 for each child under 6 for tax year 2021 and a maximum of 3000. Parents of children ages 6 to 16 also got an increase to 3000 per child in 2021 from 2000 the year before. It has gone from 2000 per.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below. Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont. The credit increased from 2000 per.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. In other words. Get your advance payments total and number of qualifying children in your online account.

There were increases in the amount that people were eligible for. When you file your 2021 tax return you can claim the other half of the total CTC. So if your kids were under six it.

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. 15 opt out by Aug. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax credit.

Before 2021 the credit was worth up to 2000 per eligible child and children 17 years and older were not eligible for the credit. Find COVID-19 Vaccine Locations With. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021.

Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return during the 2022 tax filing season. To reconcile advance payments on your 2021 return. For 2021 the credit for child and dependent care expenses is a refundable credit for taxpayers and their spouses if married filing jointly having a principal place of abode in the United States for more than half of 2021.

The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families. But this tax season might be an outlier due to the impact of expanded Child Tax Credits CTC that were put into place last year USA Today reported. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

THE IRS has launched a new tool for parents to update their mailing address in order to receive Child Tax Credits. A refundable tax credit directly reduces taxes dollar for dollar and results in a refund when the amount of the credit. Child tax credit dates 2021 latest August 30 deadline to opt-out of September payments as parents flock to IRS portal.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. 2 days agoUnder the American rescue plan there was the expansion of the Child Tax Credit. If the IRS processed your 2020 tax return or 2019 tax return before the end of June these monthly payments began in July and continued through.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. 13 opt out by Aug.

15 opt out by Nov. 1002 ET Aug 27 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

15 opt out by Nov. The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early 2022. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17.

Get It Expertly Prepared by Tax Network USA. The 500 nonrefundable Credit for Other Dependents amount has not changed. 15 opt out by Oct.

Enter your information on Schedule 8812 Form 1040. 3000 for children ages 6 through 17 at the end of 2021. 034 ET Aug 28 2021.

In previous years 17-year-olds werent covered by the CTC. IR-2021-153 July 15 2021. The credit for 2021 increased to 3600 per child under age six from 2000 in 2020.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Why Is There No Child Tax Credit Check This Month Wusa9 Com

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit United States Wikipedia

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

Moving From Child Tax Credit To Universal Credit In 2022 Daynurseries Co Uk Advice

Arpa Expands Tax Credits For Families

Child Tax Credit 2022 Calls For 3 600 Check To Be Made Permanent As Deadline Approaches See How To Apply

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Monthly Child Tax Credit Would Be A Train Wreck People S Policy Project

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Irs Child Tax Credit Payments Start July 15

Child Tax Credit 2022 Claim 4 000 Payments With No Minimum Requirement To Qualify See How To Apply For Cash

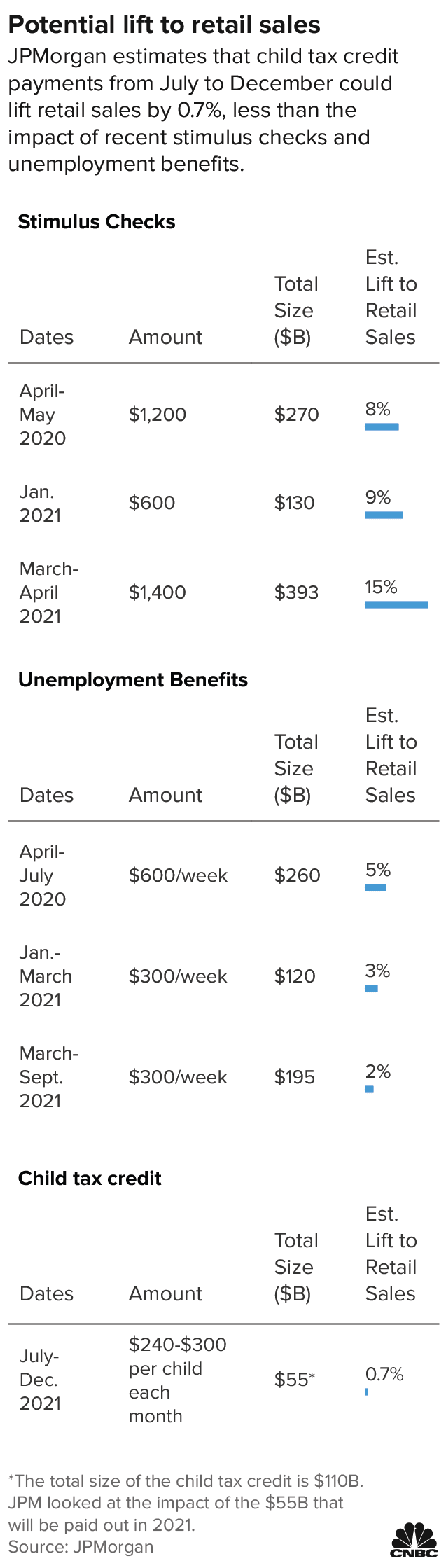

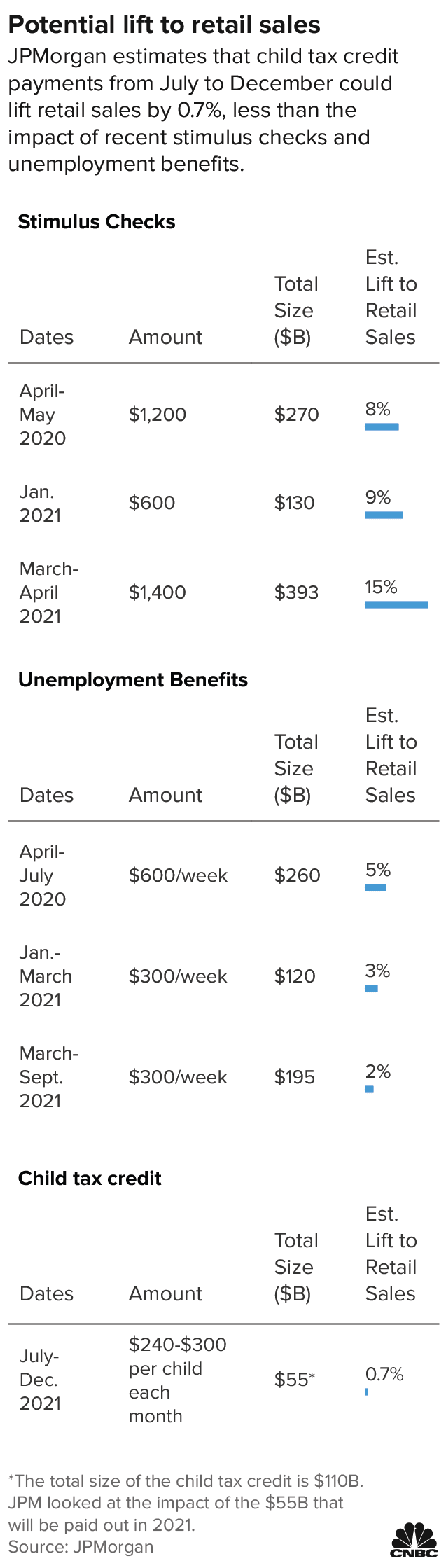

Child Tax Credit Payments May Boost Retail Sales As Soon As This Month

The Big Increase And More Changes To The Child Tax Credit In 2021